Services

Arrow Smart Finance

Using innovative finance solutions to support business

As customers’ IT budgets become tighter, they may be looking to partners to help them move away from capital expenditure and offer alternative payment options. The increasing popularity of cloud services is driving new consumption models and operational expenditure is becoming the norm.

The right finance options can not only help you win new customers, but can hep you streamline internal processes and maximise your own profitability.

Why choose Arrow?

- Flexible

The programme can be for any period or frequency that customers are requesting to a maximum length of the product support agreement. This allows partners to negotiate with customers to more effectively align investment and cash management without the need for third party financing agreements.

- Simple

Each engagement or opportunity is managed under a single Deferred Terms Agreement (DTA) which isolates the transaction outside of the standard business terms and provides clarity on timings and cash commitments.

- Innovative

With 50 years’ combined experience supporting IT funding, we’ve seen the industry change and have adapted to create new ways for customers to consume technology through our channel partners. Our goal is to help partners meet their customers’ needs, improve cash-flow and eliminate technology obsolescence.

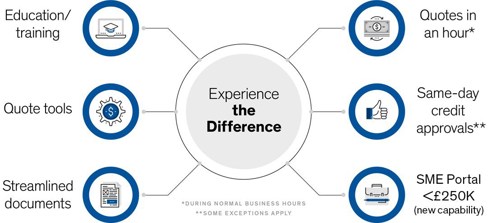

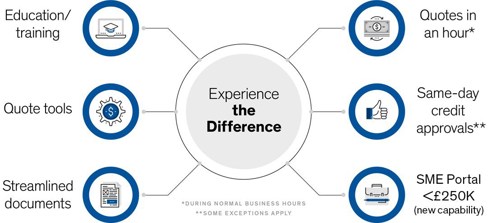

Experience the Difference

All funding solutions are underwritten by Arrow Smart Finance and not handed off to other third-party funders. This means should you or your customer ever have an issue, you only need to make one call to us.

We understand it takes time to build your confidence in what can feel like a daunting new area. However, we can provide comprehensive training to enable you to understand and talk about finance solutions more confidently.

While our aim is to make you as self-sufficient as possible, we are always on-hand to support and represent you.

Solutions

With a comprehensive portfolio of offerings, we’ve got you covered.

Frequently Asked Questions

Read Arrow Smart Solutions frequently asked questions

Get Answers

Case Studies

Find out how Arrow Smart Finance has been helping customers grow their business

Be Inspired

Top 10 financing advice

Arrow Smart Finance Solutions offers financial services that are sure to help your customers to overcome business challenges

Pro Advice

Additional Financing Options

Multi-Year Financing

Arrow Smart Finance allows you to offer your customers multi-year deals and associated discounts, without large upfront expenditure. Your customers make low, fixed and manageable payments over a period and you can benefit from larger, longer customer engagements.

Consumption Financing

Arrow Smart Finance offers a consumption model that enables customers to bring in dedicated, on-premise infrastructure under an OpEx, pay-per-use model. Consumption financing is designed to accommodate today’s compute needs, as well as provide instantly available capacity delivered on-site, day one and is only charged for when consumed.

Leasing

By leasing, not buying IT equipment, you and your customers can choose to either purchase the equipment at the end of the term, or replace it with the newest technology. As OpEx rather than CapEx, there are no large upfront investments and predictable monthly payments makeit easier to budget and plan ahead.

Total Solution Financing

Customers today operate heterogeneous IT environments and purchase solutions and services from a range of vendors. Arrow Smart Finance meets the needs of your customers, with total solution financing that wraps any vendors’ hardware, software and services into a single finance deal.